Basel III’s final reforms – explanation in a nutshell

Basel III has a history by now and enhances the Basel II framework by adding additional capital requirements (CET1 ratio), leverage ratio and two liquidity ratios (LCR, NSFR). Basel III still has a future as the latest refinements introduce an output floor, minimum capital requirements are calculated for various financial and even non-financial risks. Credit valuation adjustment risk, market risk or “FRTB” and operational risk are the new kids in town. If you do a deep dive on de new set of BIS documents a whole new universe opens up.

Basel III, Basel III.V, Basel IV

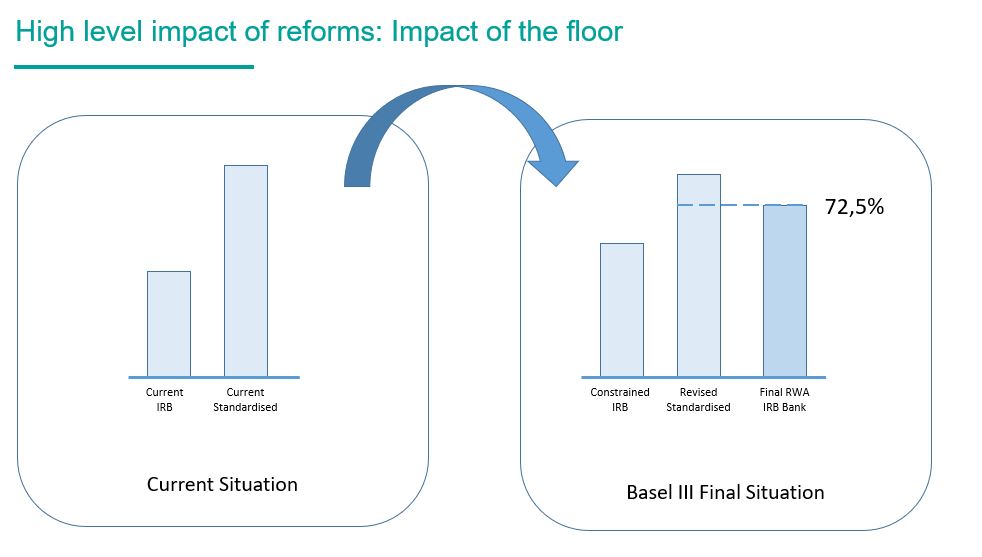

The new Basel III, or Basel III.V or even Basel IV as we call it illegally, is also expected to have an impact; in case an advanced approach is used for the calculation of the capital requirements the respective standardized approach (SA) needs to be calculated as well. Not without a reason; the minimum capital requirement is given by (on bank total) 72,5% of the standardized approach. The minimum capital requirement is given by (on bank total);

RWA = min(RWA Bank,72,5%×RWA Standardised)

Looking at the larger Dutch banks the impact varies from a 18% RWA increase for the ING Bank to 35% for the ABN AMRO Bank according to their own estimates, on a ‘fully loaded’ basis. The party starts as of 1 January 2022 by the way. The Core Tier 1 Equity increases by 11-13% approximately according to DBRS calculations. The aggregated IRB RWA floor has the largest effect; 130bps by looking at 130 banks participating in a transparency exercise as of HY1 2016. To put this into perspective; IFRS-9 was good for 30bps.

The main changes from standardized approach (SA) to revised SA itself are also tangible in the new truth as defined by the Basel Committee;

- new risk weights for the majority of the asset classes have been set;

- a higher granularity of risk-weights (e.g. dependency on Loan-to-Value for Real Estate);

- new methodologies for bank exposures.

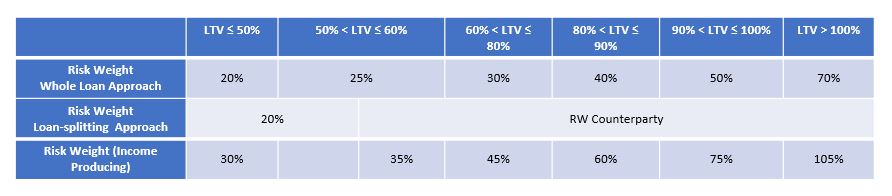

Especially the solid but highly leveraged Dutch residential real estate mortgages market is under siege; under the current SA residential mortgages (occupied or rented) are always risk weighted at 35%, even though the national supervisor may increase risk weight as a form of expert judgement. Under the new revised SA these same asset class is risk weighted according to LTV, but also risk weights are differentiated by repayment of loan being materially dependent on cash flow generated by the property. For non-income producing real estate the Whole Loan approach or Loan-splitting approach could be applied.

Exhibit 1, on Exposures Secured by Real Estate

The main changes for Advanced IRB are the removal of the use of A-IRB for specific asset classes (e.g. large and mid-sized corporates, banks), the use of expert models and the scaling factor. Besides these changes the input floors on the IRB parameters increase.

Exhibit 2, on Inpact of the floors on the A-IRB

The consequences of the changes of the Basel framework are definitely visible, especially from a workload and data perspective; the IRB approach also requires the RSA approach calculations for comparison and the RSA requires (usually) different risk drivers. The data requirements are severe, as e.g. 2 LTV’s need to be sourced and one has to proof that property is not income producing), data quality standards can be problematic (e.g. collateral data) and there is a removal of expert models in favor of statistical models.

Business models with a high impact due to Basel IV under IRB are those that have a large deviation from a “average” amount of risk:

- Mortgages in The Netherlands traditionally have a low PD and low LGD;

- Asset based finance: the LGD of Asset based finance is very low since the underlying collateral is monitored very strictly;

- Qualifying Retail Exposures.

Calculation examples

Example 1

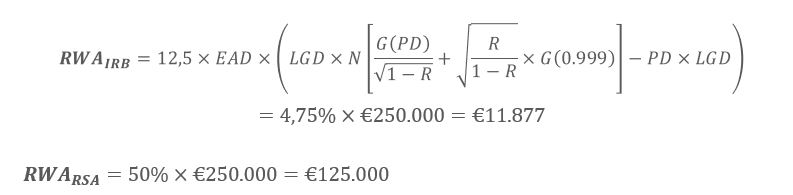

Let’s take a stylized example of a portfolio consisting of only one mortgage. The output floor should be applied on bank level but the example gives an indication why the capital needs to be increased.

Consider a mortgage loan of € 250.000 with a tenor of 10 years, for which repayment is not materially dependent on cash flows generated by the property has the following IRB parameters: PD = 0,1%, LGD = 20%, LtV 95%.

Additional Regulatory Capital (contract level) =72,5%×€125.000 −€11.877=€78.748

Capital requirements for this mortgage increase by a factor 7!

Example 2

Another example; a mortgage loan of € 250.000 with a tenor of 10 years, with PD at 1%, LGD at 20% and LtV 50%.

By applying ???〗_???=25,07% ×€250.000=€62.665 and 〖???〗_???=20%×€250.000=€50.000 the implied extra capital for the contract is 0.

Example 3

For a portfolio containing the mortgages of both examples we have:

???〗_???=€11.877+€62.665=€74.542 and 〖???〗???=72,5%×(€125.000+€50.000)=€126.875

Additional capital of the first mortgage has “decreased”. The portfolio composition determines if there is an impact of the new legislation.

The above implies the following:

- for A-IRB Banks one needs to calculate two approaches;

- the portfolio composition determines the overall impact;

- There is no possibility for expert models;

- There will be a move from A-IRB approach to RSA or Foundation IRB (F-IRB);

- There will be a non-level playing field banks vs. Insurers and Pension funds.

Most Dutch banks are using the IRB approach to calculate RWA. It will be challenging for them to also calculate the standardized approach correctly since the drivers are very different from the ones needed for IRB. All models will have to be driven completely by data and there is no longer the possibility for expert models. The Basel models for certain asset classes will cease to exist because only the F-IRB approach is allowed. The new regulation will generate a non-level playing field between banks on the one side and insurance companies and pension funds on the other side (Solvency and FTK instead of Basel). Will banks need to redevelop their business model or is a decrease of RoE a possibility for the shareholders? That’s the key Q.

Door: Robert Jan Sopers (Risk Consultant) en Stephan van Weeren (Managing Consultant) van Triple A – Risk Finance

-

Continue talking with

Triple A? E-mail

+48 506 560 664

Do our themes appeal to you and is our culture exactly what you are looking for? Take a look at our vacancies. We are always looking for talent!

-

-

More information or a conversation with us?

Please contact Maciej Stachnio

© 2025 AAA Riskfinance. All rights reserved.